CIBC Research sees great GPS growth

location based services

17 April 2007

Here is a timely piece from the New York Equity Research group at CIBC World Markets on the folks making hay in the GPS space right now. They see great growth continuing at NAVTEQ (NVT:NASDAQ) and Garmin (GRMN-NASDAQ).

We’ve looked at a few of the smaller stories, and this data reminds one why it is so tough. These firms are just so entrenched. One of our Fund II portfolio companies, Intrinsyc Software (ICS:TSX) has found a different way to play it, and recently announced that they were working on a software platform for an actual device manufacturer, for example.

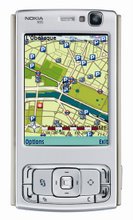

The Blackberry 8800 is being advertised at a local retail shop as having “GPS”, and the ad campaign has begun as well. Speaking for myself, it would be easier to have that feature than carry around a map in your breast pocket if you are attending a day of meetings in Calgary, for example.

But despite the great growth called for by CIBC here, most of the land has been grabbed at this stage:

“We are launching coverage of the Applied Technology sector with an initial focus on GPS and location-based services. We believe this market is in its early stages and that total unit shipments of navigation systems will expand at CAGR of 27% through ‘11—a trend that should benefit both Garmin (GRMN-SO) and NAVTEQ (NVT-SP).

Consumers have been relatively quick to appreciate the attractiveness of vehicle navigation systems. In 2006, more than a decade after the products began hitting the market, year-on-year volume growth continued to clock in above 50%. In all, approximately 4 million vehicle navigation systems were sold in North America last year and approximately 13 million in Europe.

Yet that still leaves the market vastly underpenetrated. According to our estimates, less than one in ten cars in North America and Western Europe have some kind of navigation system, and in 2006 only about one in nine new cars arrived at the dealership with in-dash navigation systems. In all, we estimate that, entering 2007, only 7% of the addressable North American and Western European markets had been penetrated.

So how high could penetration eventually go? Quite high, in our view. According to a study by NAVTEQ, approximately 85% of navigation system owners across the UK, Germany, France, and the U.S. were somewhat or very satisfied with their device and would recommend it to others. With that level of satisfaction, it’s easy to imagine navigation systems one day becoming as prevalent as automatic transmissions, power windows, and air conditioning — if the price is right. But price is no minor matter. In the last few years, pricing has played a pivotal role in the growth and competitive dynamics of the navigation market. During 2006, the staid carmakers, who continued to demand a hefty premium for their factory installed in-dash systems, saw nav unit sales grow at the relatively modest rate of 12%.

By contrast, the makers of portable navigation devices (PNDs), who slashed prices, reduced costs, and launched dozens of new models, saw their industry’s unit volumes expand by a whopping 160%. In 2006, PNDs outsold in-dash systems at a rate of approximately two and a half to one. And it wasn’t bad business, either. In 2006, earnings for the world’s top two makers of PNDs, TomTom and Garmin, grew 55% and 71%, respectively.

In our view, this outperformance will last for several more years. The first reason is that PND makers are targeting a much larger addressable market—approximately 415 million nav-less in-service vehicles — compared to the 34 million new cars OEMs sell annually. Second, the price-value equation is likely to continue tilting heavily in favor of the PND for at least a few more years. And last, though by no means least, the short development and production cycle of the PND makers puts them in a better position to respond to the fast-changing tastes of an emerging market.

In the longer term, we believe that the navigation market is the carmakers to lose. The history of the automobile suggests that every relevant accessory that can be integrated into the vehicle will be in time. Consider the fate of the aftermarket air conditioner, the CD player, and the lowly cup holder. Yet the vehicle makers’ ultimate ascendancy could be a long time coming. For the next few years, the OEMs’ abiding affection for the $1500-$2000 price tag of their indash nav systems will in all likelihood keep consumers lapping up the PNDs.

We estimate that unit volumes for PNDs will expand at a CAGR of approximately 31% for the next five years and grow to approximately 56 million units in 2011 from approximately 14 million units in 2006. In dollar terms, we expect the PND market to grow at annual pace of 21% over the next five years, to approximately $12 billion in 2011 from approximately $4.5 billion in 2006.

The vehicle mapmakers whose databases are the cornerstone of every navigation systems are also likely to see robust growth, though their expansion could be hampered by the slower growth of the in-dash market. We forecast that total map volume will increase to 65 million in 2011 from 7 million in 2006, a CAGR of 27%. In dollar terms, we estimate that the market for digital maps will expand at a CAGR of 13% over the same period to approximately $1.9 billion in 2011 from approximately $1.0 billion in 2006.”

MRM

No comments:

Post a Comment