Where in the world am I? Your phone might know

location based services

NEW YORK — Jacqui Fahrnow used to worry when she couldn't reach her teenage boys on the cellphone.

"My oldest son wouldn't answer because he was playing basketball and left the phone in his duffle bag," says Fahrnow, a single mom in Shawnee, Kan. "It was a point of contention."

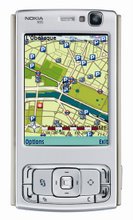

Now, Fahrnow has signed up for Sprint Family Locator by WaveMarket, a wireless location-based service — or LBS — launched in April by Sprint Nextel. From her own cellphone or the Web, Fahrnow can track the whereabouts of her kids' cellphone in real time on an interactive map, without them having to take a call.

The $10-a-month Sprint service, and most other emerging LBS technologies that work on wireless phones, use the same Global Positioning System satellites that keep car navigation systems on course. Fahrnow says Family Locator has been accurate within 11 yards.

Since the late '90s, LBS has been linked to a host of intriguing, yet somehow not-quite-ready-for prime time, mobile scenarios involving local search and advertising, gaming, dating and perhaps most promising, safety and security.

Yet, despite mounds of hype, few companies rolled out services, and LBS has mostly been lost on regular consumers. LBS is the killer application "that got killed on the way to mainstream," says Joe Astroth, vice president of the Location-Based Services division at Autodesk, which provides the technology to wireless phone carriers.

Now, there's evidence that LBS might have a pulse with the masses, after all. Market researcher Frost & Sullivan forecasts the total LBS market in the USA to exceed $600 million in 2008, up from about $90 million at the end of 2005. "There seems to be a fair level of commitment to the technology now, giving a big sigh of relief that it is finally happening," says Ken Hyers, an analyst at ABI Research.

Several services recently made their debut or are coming soon. A sampling:

• When it arrives this month, Disney Mobile-branded phone service will include a family finder capability akin to what Sprint is offering. Verizon Wireless is about to launch a service called Chaperone. For $20 a month, parents can establish a virtual fence around a child's school during set hours and receive a text message when a kid goes outside the boundary. Similarly, Wherify Wireless is planning to peddle a locator phone in the back-to-school timeframe.

• Verizon's Networks in Motion VZ Navigator service transforms certain LG or Motorola phones into portable navigation systems for $10 a month, or $3 for a day. The phone tells you where you are and which restaurants, hotels and shops are nearby, and provides turn-by-turn directions to get you to those destinations. Sprint offers a similar navigation service through TeleNav.

• Sprint and InfoSpace recently launched a $3-a-month subscription-based LBS search engine, InfoSpace FindIt, that lets you find local businesses and services, and click to call them without dialing the number.

There are a raft of other offerings, from friend and pet finders to lifestyle applications. In business, LBS has been used for managing fleets and tracking mobile workers. Researcher In-Stat predicts growth on the business side from 582,000 to 1.1 million subscribed devices by the end of 2010.

Tech tools in place

Why now? For one thing, the technological infrastructure is largely in place. Wireless carrier networks are faster and more robust. More phones have decent color screens and extra horsepower to run LBS applications.

What's more, many cellphones, mostly those that work with Sprint Nextel and Verizon networks, now incorporate GPS chips, partly as a response by carriers to a government-mandated Enhanced 911 program that was phased in at the end of last year. Uncle Sam wanted emergency workers to find folks who dial 911 from their cells.

(Other companies met the E911 mandate through "triangulation" methods that measure the time it takes signals to bounce off cell towers, or the angle of those signals.)

Brent Iadarola, industry research manager at Frost & Sullivan, expects the LBS market to get an additional boost in a couple of years when carriers such as Cingular Wireless and T-Mobile add GPS capabilities.

Once companies know where a handset is, they can construct applications that build on that knowledge. "If you're traveling on the interstate, you don't (necessarily) want to find the nearest gas station if it's by the exit you just passed," says Mike Gerling, president of map provider TeleAtlas North America. "You want to find the next one."

Having the proper technology in place is only half the battle. Reaching consumers and getting them to pay for services might be a bigger roadblock. "I don't think the average consumer knows what location-based services means," Gerling says.

The good news for the industry is that people are increasingly familiar with in-vehicle and portable navigation systems. Based on its monthly online survey of 50,000 U.S. households, market researcher Synovate says about 20% more Americans bought a GPS system in 2005 than 2004.

Many people are comfortable using Google Maps and MapQuest. Israel's Telmap and MapQuest introduced MapQuest Navigator, a cellphone service coming this summer. Carriers have not been announced.

In a survey of more than 4,000 consumers 18 and older, the C.J. Driscoll & Associates market research firm found that about one-third of U.S. cellular subscribers expressed a strong interest in cellphone-based navigation assistance services. That was greater than their interest in cellphone-based e-mail, photos, video-downloads or live TV viewing.

More than 80% said they'd pay either a monthly fee for the service or on a per-transaction basis for driving directions. Social applications such as locating nearby friends and finding close bars and clubs tested well with survey participants under 35.

A Starbucks sniffer?

But LBS can also smack of Big Brother. Marketers banking on LBS have to step gingerly. "LBS is technically feasible today. It's more a matter of trust and privacy (among consumers)," says Deep Nishar, director of product management at Google, which has yet to provide a mobile LBS offering.

One scenario bandied about for years involves consumers getting text alerts on their cellphones for discounted coffee as they wander near a Starbucks. "Having a pop-up every time you pass by a store may be what advertisers want, but it's not what users want," says Dan Gilmartin, who runs consumer LBS marketing for Sprint.

Verizon Wireless COO Lowell McAdam agrees: "It would annoy me to no end if every time I passed by a Starbucks, (the phone says) I got 20 cents off."

AstroLeap has developed a location-based couponing system called Eureka Mobile that would require consumers to actively opt in, then expressly seek out coffee (or whatever). Only then would they be notified of nearby coffeehouses and possible discounts. The San Diego company hopes to launch with major carriers in the next three to six months, says co-founder Dan Bailey.

"I do think there's a mass-market opportunity for (location-based) advertising," says Astroth. "But it has to be personalized, permission-based and in the context of the activity you're participating in."

Consumers attending a baseball game might not mind receiving a downloaded ring tone of Take Me Out to the Ballgame. In another context, they'd the find the sudden arrival of such a ring tone intrusive.

For now, navigation and local search seem to be the furthest along with additional services such as traffic monitoring starting to emerge. TeleNav in Santa Clara, Calif., helps subscribers find nearby gas stations with the cheapest fuel prices.

"The big applications we expect to drive LBS adoption are those services that have already succeeded in some capacity but are enhanced and become more compelling by integrating location," says Iadarola of Frost & Sullivan.

Rod Diefendorf, a vice president at mobile search provider InfoSpace, says that eventually, consumers will be able to search beyond general categories — such as finding a seafood restaurant — to satisfy particular cravings for lobster or other menu items.

Photography is another emerging area. Digital snapshots typically capture information, including the time and date an image was taken, and the kind of camera used. Now, companies are starting to add "location stamps."

Otherwise, "one year down the road, you have no idea where those pictures were taken," says Kanwar Chadha, founder of LBS chipmaker SIRF Technology. Location-stamped pictures might also help you resolve insurance disputes, or locate all the vacation pictures you took by the Eiffel Tower.

Disney's presence and the peace of mind that comes with making sure loved ones are safe would seem to be a big driver toward ensuring LBS' success. But Allyn Hall, the director of the wireless practice at the In-Stat research firm remains skeptical: "When I call my wife and want to know where she is, I ask her," he says.

Still, Ben Starkey uses TeleNav on his Nextel cellphone to keep on top of his pregnant financée's whereabouts. "It's a comfort thing," says Starkey, a data technician in Roanoke, Va., who jokes that the phone best not be turned off or he'll be in the doghouse.

"We've been saying LBS is coming since 1999," says Sal Dhanani, senior marketing director of TeleNav. "This time, it feels a little more real."

Posted 6/1/2006 9:41 PM ET

E-mail Save Print

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment