Switzerland-based u-blox AG, a global provider of GPS (global positioning system) chipsets and modules, has been actively seeking cooperation with Taiwanese hardware makers, especially hand-held device manufacturers, to tap the fast growing global market for GPS-enabled devices. DigiTimes had a chance to interview u-blox CEO Thomas Seiler during his business visit to Taiwan.

Q: Can you provide a bit of background about u-blox's involvement in the GPS industry?

A: We have been a player in the GPS market from the early days, and we were the first clients of SiRF, who was the supplier of our GPS chips at the time when we used to make only modules. U-blox created the first surface mount module for the GPS technology, and later we decided to design our own chipsets, which is the core of our GPS technology, and we have a decent know-how of the location based service solution.

Q: Not many module makers in the GPS industry have their own chipset solutions. Taiwan module makers such as GlobalSat, Holux, and RoyalTek are significant players of the module market, even though they are active in the end-user products such as personal navigation devices (PNDs), they have not yet developed their own chipset solutions. That is quite an interesting shift for u-blox, can you please elaborate on how your company made the transition?

A: U-blox already had a large market share in the module industry before we thought about starting to design our own GPS chip solution. Things have changed really fast over the years, the sizes of modules and antennas are shrinking to millimeters, and we learned that by only making modules, u-blox cannot provide full support to the standard that our clients require. In order to deliver a total solution to our customers, we need to have access of the GPS technology to the core, and that's why we decided to start designing our own chipsets.

As chipset technology improved over the years and expanded its capabilities, the market demand for GPS modules began to slow down, proving that acquiring the core technology of chipsets was a right decision. U-blox is still one of the largest manufacturers in the module market because of the customized solutions we offer. The company now enjoys an over 50% revenue growth every year, and we not only hold a 20-30% market share worldwide in the module business but also stand as the number two vendor for GPS chipsets.

It is important to keep in mind that using GPS integrated modules is the easiest way to get into the GPS end product. Though chipset technology is the core, the two have to go hand in hand for a company to remain competitive in the market. Because u-blox has grown so fast, we have great advantages in expanding our economy of scale and saving production costs, which give us a good position in the market. The cost advantages give u-blox a good lead in price competitiveness. Of course there is a market for companies who try to make modules on their own or sell just modules in the market, but with a focus on integrating chipsets and modules so that they work well together gives great flexibility in the solutions we offer, and at a price that's difficult to beat as well. Aside from the cost advantage, providing our own chipsets makes us the owner of the IP, and that gives a different relationship with our customers in terms of service support.

Q: With chipset players like Garmin, Sony, uNav and Trimble doing their own things in totally different fields, it seems difficult to define the various segments in the GPS market and even harder to calculate market share in the chipset market. How does u-blox look at SiRF's dominance, with close to an 80% share of the car navigation segment, in the chipset market?

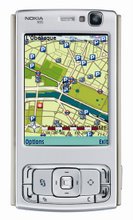

A: SiRF is certainly a challenge to players in our market with a large market share. It has definitely established its brand recognition from ordinary navigation device consumers and taken the advantage of being the first player in the field. However, with a wide range of applications pouring into the location based services, there has been tremendous growth momentum in the market and we believe that u-blox still has a good chance of gaining more market share and definitely looking forward to further growth in sales. Particularly in the segment of mobile terminal we see great opportunities for u-blox, mobile devices such as cell phones, smartphones and portable PCs pose a large demand for GPS technology.

Q: Is u-blox currently working with Taiwanese PND ODM/OEMs? If yes, in what market segments is u-blox focusing on at the moment, and which segments is your company looking forward to explore in upcoming years?

A: U-blox has many Taiwanese manufacturing partners. At the moment mobile handsets is the main area we have been investing our resources in for years, and we have also been exploring the computer accessory segment of the market as well. GPS mouse, Bluetooth solutions and cell phones are the major applications in Taiwan right now. There is still some room for growth in the GPS mouse segment, but the cell phone market is definitely coming up with high volume demands for GPS solutions.

We do feel that our strength in high sensitivity and low-power consumption GPS solutions position us to lead in the mobile handset segment. In terms of combining mobile phones with GPS navigation technology, high resistance against interference in the city and low power consumption for portable consumer electronics products are becoming the basic requirements. Also, cost is very important for GPS solutions targeting the mobile phone market. Cell phones are already integrated with many other entertainment applications such as digital cameras and MP3 players, and low cost is a significant factor that helps to convince cell phone vendors and consumers to include GPS technology to their feature phones. Small size and any cost reduction are the two major things clients look for in a cellular GPS solution.

Other applications of market opportunities are mobile devices like camera, gaming, and personal tracking, and these things must be made small, able to pick up signals indoors and outdoors.

Cost has been a major issue for our clients, and now we make our solutions for only a few dollars. Below US$6 is what we offer for a full GPS receiver solution, but the market is always demanding for something even less. It is important to overcome these challenges, to win specific accounts, and make an early entrance – this will determine whether a company can maintain a position in the market or not in the long run. That is why we are also proposing to hit emerging markets like Asia, and we are looking forward to setting up an office in Taiwan.

Q: As brands like TomTom and Garmin take large market shares in the GPS market, they often decide which chipset provider they will partner with, who ends up as the mainstream choice of chipset solution for new comers. If that is the strategy SiRF is taking, by working with the major players, how do companies like u-blox find its place in the growing market?

A: This is the question of the ecosystem and how that we are developing in that system. We must drive a possibility that has a technological impact. After acquiring Gate5, Nokia is now making investments in this domain, it shows that GPS technology is right to support the ecosystem and that around the pure positioning information there has been new development for the whole thing to work. When all components are ready at its best quality, the market is ready to take off. U-blox feels that the ecosystem for the GPS market is ready because there are full packaged solutions to convince people to buy.

Q: What are the key elements of this ecosystem for the navigation market? How about the A-GPS (assisted GPS) tracking system market?

A: There are a few requirements for a mature ecosystem. The hardware must reach a certain performance level, it must navigate well in all sorts of conditions. If a device can operate with little errors, interruptions, and is able to pick up signals fast, then the mass market can accept it.

Chipsets that do not have enough sensitivity or are too slow at startup and calculating routes cannot be placed into a cellular device, since the users will not even consider to purchase a GPS enabled phone if it slows down its primary communication function. Software and services are also important. It is a lot easier to get digital maps now, whether you are in Taipei or anywhere in Europe. Maps come in large files, and they are difficult to get. Now software vendors make them available all over the globe on SD cards.

But that is just the navigation market, A-GPS tracking is different. Tracking application has two elements: knowing where you are and transmitting that knowledge to somewhere else. And both elements have had weaknesses for some time. We are on the side of knowing where you are not transmitting, but we have seen a lot of progress in this market. Standard phone modem work very well for these applications, and major markets like the Americas and Europe are already covered, many applications simply use satellite radios to transmit information because the coverage needed for rural areas is too large. Areas where there is no cell phone coverage, there can be interference. We could use hybrid systems to reduce interference, it makes the system more stable, but not many people are ready to pay for extra cost. But still we believe the approach to tracking technology is mature enough, and the market demand to track down missing persons and pets is growing.

No comments:

Post a Comment