Studies point to big LBS uptake

location based services

NEW YORK—Two research firms say the future looks bright for location-based services running on Global Positioning System technology.

ABI Research’s latest study on the subject suggests that subscribers of GPS-enabled LBS services will reach 315 million by 2011, up from 12 million this year. The firm points out that the increase represents a rise from less than 0.5 percent wireless subscribers today to more than 9 percent within 5 years

Ken Hyers, senior analyst at ABI, explained that North America and Western Europe will see the greatest growth, while countries in the Asia-Pacific region will see varying growth rates. “Leaders South Korea and Japan will continue to be engines of LBS growth, but North America, which has seen strong business use for several years, is expected to see significant consumer uptake in 2007 and beyond,” said Hyers.

ABI said the LBS market took off first in South Korea and Japan, driven by personal navigation and some family- and people-finder services. In the United States, Nextel Communications Inc. and Sprint Corp. initially drove LBS adoption with a focus on fleet applications, and this year Verizon Wireless entered the market. Verizon Wireless has three applications available, and as many as five more planned for rollout during the coming months.

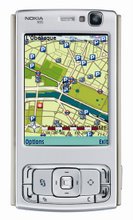

However, market growth in Western Europe has been limited by the fact that very few GSM/W-CDMA handsets have GPS, but ABI Research expects that beginning next year and increasing in 2008, many more W-CDMA 3G phones will contain GPS chipsets, allowing operators to offer LBS. Anticipating this, ABI said at least one additional operator will be offering GPS-enabled LBS in Europe starting late this year, and ABI Research expects that in 2007, at least four major operators in the region will follow suit.

What’s more, Hyers predicts that GPS services will drive the adoption of UMTS 3G handsets. “3G growth has been limited by customers’ low uptake of many 3G services, making it uneconomical for operators to subsidize these handsets heavily. GPS-enabled LBS is expected to lead subscribers to use more 3G data services, and thereby to drive overall 3G handset sales,” Hyers said.

A new study from IMS Research suggests there will be a significant increase in the number of GPS-enabled handsets shipped in 2008, coupled with an increase in A-GPS network rollouts worldwide.

IMS Research forecasts differing degrees of growth for each of the major cellular technologies, each one having its own market drivers and inhibitors. The firm said overall growth is reflected by sales of GPS-capable phones, which is forecast to have a CAGR of just under 40 percent during the next four years.

Patrick Connolly, GPS analyst at IMS Research, noted that, in order to reduce costs, the move toward single-chip design will accelerate next year. The firm said it expects that there will be an increased effort to get power consumption and size down to meet the constraints of increasingly over-burdened handsets, and that these solutions initially will target laptops, cameras and portable GPS units rather than cellular handsets.

The overall effect, according to IMS Research, is that GPS solutions are becoming more appealing to handset manufacturers and network operators. Already a number of handset operators are planning to release GPS-enabled handsets targeting the mass market, rather than previous niche-market solutions. This is partly driven by imminent A-GPS announcements from network operators, but also the potential to offer autonomous GPS and server-based location services via application service providers, the firm said. As GPS proliferates in the cellular market, there is huge potential for increased revenues for network operators offering a broad range of GPS-based location services.

However, Connolly warned, “Location services have been around for years, via network-based triangulation, but have been poorly exposed and marketed to end users. If GPS-enabled handsets and location services are to take off beyond mandated regions, there needs to be a dedicated push to make end users aware of the exact services that are available to them, coupled with competitive pricing models.”

Furthermore, IMS Research said that an end-user survey carried out as part of its report clearly indicated that consumers make a direct correlation between cellular GPS and satellite –navigation, and were unaware of the full potential of cellular location services. To distinguish these services from other GPS solutions, “service providers need to offer more than just sat-nav solutions and highlight all the other benefits of having GPS in your phone,” the study said.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment