TeleCommunication Systems Reports Second Quarter 2006 Results

location based services

Thursday August 3, 4:11 pm ET

Same Quarter Revenue up 49%; $0.02 Per Share GAAP Income; Record Revenue and 2nd Consecutive Profitable Quarter from Continuing Operations

ANNAPOLIS, Md., Aug. 3 /PRNewswire-FirstCall/ -- TeleCommunication Systems, Inc. (TCS) (Nasdaq: TSYS - News), a global leader in mission-critical wireless communications technology, today announced results for the second quarter ended June 30, 2006.

* Revenue was $31.9 million, up 49% from $21.4 million in Q2 2005 and up

slightly from the $31.7 million in the previous quarter. This was the

second consecutive quarter of record revenue from continuing operations.

* Gross profit was $14.2 million, up 45% from $9.8 million in Q2 2005 and

up 4% from $13.6 million in the previous quarter.

* GAAP income from continuing operations was $0.8 million or $0.02 per

share, up from $0.3 million or $0.01 per share in the previous quarter,

and compared to a loss of $2.3 million or $0.06 per share in Q2 2005.

For Q2 2006 costs and expenses include $0.7 million more non-cash stock-

based compensation than a year ago because of the new accounting

requirements of SFAS 123®.

* GAAP net loss from combined continuing and discontinued operations was

$1.6 million, or $.04 per basic and diluted share, an improvement from a

net loss of $4.0 million, or $0.10 per basic and diluted share for Q2

last year.

* EBITDA was $4.7 million or $0.12 per basic and diluted share in Q2 2006,

up from $0.5 million or $0.01 per basic and diluted share in Q2 2005.

(See important discussion about the presentation of EBITDA, below.)

"This is our second consecutive quarter with strong results across the board," noted Maurice B. Tose, TCS chairman, president and CEO. "Continued growth in the use of text messaging in the U.S. has resulted in two first-half major carrier purchases of message center software license capacity. This has fueled strong carrier software results in our first half and provided a return on past investment in carrier software R&D, demonstrating that our carrier license/maintenance strategy is on the right track.

"Strength in E9-1-1 and federal business, along with the continued vitality of our wireless carrier messaging software business, have strengthened our initiatives in wireless location-based technology. While the results for the first half of 2006 are gratifying, we are also excited and encouraged by the improving visibility into Voice Over IP E9-1-1 opportunities, and growing user awareness of location-based services using the same handheld devices they use to make phone calls. We're now seeing regular television ads stimulating the market with early location-based offerings. We are ready to meet this growing demand with proven, award-winning wireless network location technology.

"During the quarter we also stepped up the program to optimize the return on our investment in intellectual property. We secured our 43rd U.S. patent, responded to bids for non-strategic patents that we offered for sale, and initiated infringement litigation. Our Enterprise division assets have attracted interest from multiple parties. There are now more than 5,000 users of our CDMA subscriber service, Reuters is now a distribution channel for marketStream®, and we expect 2006 revenue from our 20/20 logistics solution to be more than 50% higher than that of 2005. We plan to announce asset dispositions before year end."

Highlights

Commercial

The TCS Xypoint® Secure User Plane for Location (SUPL) successfully

demonstrated the capability of mobile call flows conducted with all

handset manufacturers' phones that participated in the Open Mobile

Alliance's (OMA's) TestFest in Belfast, Ireland.

TCS unveiled two new innovative location-based services. TCS Places

identifies local services and their precise locations and TCS Handset

Locator finds missing handsets instantly via the Web. TCS Places is an

innovative service that provides the means for subscribers to have instant

access to their content and services while "on-the-go." TCS Places was

named a semi-finalist in the 2006 NAVTEQ Global LBS Challenge.

TCS introduced industry-leading MSAG-Based Routing for VoIP 9-1-1 Calls.

This technology allows VoIP service providers to meet recently requested

public safety requirements. It facilitates the routing of 9-1-1 calls that

are made from a VoIP service subscriber to the Public Safety Answering

Point (PSAP) emergency call centers. This solution applies to both static

and nomadic VoIP emergency calls; nomadic users, that is, those who take

their VoIP device from place to place, represent a higher level of

technology challenge than "static" users.

TCS and Rand McNally released a second mobile phone application,

StreetFinder® Wireless, and launched Rand McNally Traffic for

Blackberry. StreetFinder Wireless delivers easy access to maps,

directions, and directory listings for the entire United States. The

application is powered by TCS Places. Rand McNally Traffic leverages the

BlackBerry Enterprise Solution(TM) to deliver unlimited, up-to-the-minute

traffic information for 94 U.S. metro markets -- more than any other major

wireless traffic application available today.

TCS introduced a new interface for its wireless Short Message Service

(SMS) platform that enables wireless carriers to offer premium messaging

to their subscribers. The new interface represents the company's venture

into the Internet Protocol Multimedia Subsystem (IMS) arena with SMS

delivery over wireless Internet Protocol (IP), and opens new revenue

opportunities.

TCS launched an enhanced messaging solution for Mobile Virtual Network

Operators (MVNO). This feature-rich MVNO application is designed to help

carriers and data-centric MVNOs deploy enhanced messaging services. The

application provides a branded consumer messaging portal and supports

e-mail-to-mobile messaging.

TCS was issued its 43rd patent, covering innovative technology that

enables authorized access to remote information on the Web and corporate

databases. Mobile devices, equipped with a Web browser, can select and

receive information from internal company servers or from the Internet.

Administrators can set user priorities and selectively control information

access.

Government

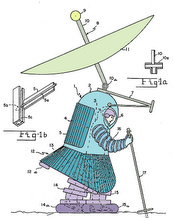

The U.S. Coast Guard procured custom-configured TCS SwiftLink®

Deployable Solutions for emergency use. This order represented the Coast

Guard's first custom-configured SwiftLink Deployable Very Small Aperture

Terminal (VSAT) communications system. This end-to-end solution enables

Secret Internet Protocol Router Network (SIPRNET) secure voice and data

satellite communications between SwiftLink man-portable units and TCS home

stations on the east and west coasts of the United States.

TCS added the Asia Pacific to regions covered by SwiftLink® Global

Satellite Services. SwiftLink now supports VSAT deployable communications

in major global regions including North and South America, Africa, Europe,

the Middle East and West Asia.

TCS will support USfalcon, Inc. on a 5-Year U.S. Army Contract. TCS will

be a subcontractor to USfalcon on a Strategic Services Sourcing contract,

and will assist in providing professional services to U.S. Army's

Communications-Electronics Life Cycle Management Command.

Financial Details

In order to streamline reporting, the company now reports the former revenue and gross profit captions of "Hosted, Subscriber and Maintenance" and "Services" under the singular caption "Services."

Revenue and Gross Profit from continuing operations compared to second

quarter 2005 results:

Three months ended June 30,

2006 2005

Comml. GVMT Total Comml. GVMT Total

Revenue ($millions)

Services 15.5 7.1 22.6 12.7 4.8 17.5

Systems 3.8 5.5 9.3 1.8 2.1 3.9

Total revenue $19.3 $12.6 $31.9 $14.5 $6.9 $21.4

Gross profit ($millions)

Gross Profit-services 7.2 1.8 9.0 6.7 1.8 8.5

As % of rev 46% 25% 40% 53% 38% 49%

Gross Profit-systems 2.9 2.3 5.2 0.7 0.6 1.3

As % of rev 76% 42% 56% 39% 29% 33%

Total Gross Profit $10.1 $4.1 $14.2 $7.4 $2.4 $9.8

As % of rev 52% 33% 45% 51% 35% 46%

(Gross Profit = revenue minus direct cost of revenue, including amortization of software development costs and related non-cash stock compensation, excluding Enterprise Division operations.)

Services revenue and gross profit

Revenue from hosting, subscriber, and maintenance services, mainly for wireless and VoIP carriers, and technical services, mainly for government customers, was $22.6 million in the second quarter of 2006, up 3% from $21.9 million in the previous quarter, and up 29% from $17.5 million in same year- ago quarter. The year-over-year growth is due mainly to continuing growth in Voice over IP E9-1-1 business, and in professional and teleport-based services for government customers. The gross profit from this category of revenue was $9.0 million or 40% of revenue, as compared to $8.8 million or 40% of revenue in the previous quarter, and $8.5 million or 49% of revenue in the second quarter of 2005. Margins in the first half of last year included a government service contract with unusually favorable margins.

Systems revenue and gross profit

Revenue from sales of systems was $9.3 million, down slightly from $9.7 million the previous quarter, but more than double the $3.9 million for the same period in 2005. Commercial systems revenue of $3.8 million for the quarter was up from the prior quarter's $3.5 million and included a $2.8 million license capacity sale, which was in addition to a $2.1 million license capacity sale in the previous quarter. Last year's second quarter commercial systems revenue was $1.8 million. Sales of government systems were $5.5 million, up 162% from $2.1 million a year ago and down 13% from $6.3 million in the previous quarter. Commercial systems sales were $ 3.8 million, up 8.6% from $3.5 million in the previous quarter and up 111% from $1.8 million in the year-ago quarter.

The gross profit from systems sales was $5.2 million or 56% of revenue, versus $4.8 million or 49% of revenue in the previous quarter, and $1.3 million or 33% of revenue in the second quarter of 2005. In quarters when large capacity license sales occur, gross profits are higher than normal.

Cash operating expenses (research and development & sales, general, and administrative expenses)

Research and development expense in the second quarter 2006 was $3.5 million, versus $2.9 million in the previous quarter and $3.2 million in the same period in 2005. Sales and marketing expenses totaled $3.1 million, up slightly from the previous quarter of $3.0 million, and up 15% from $2.7 million in the same period in 2005. General and administrative expenses totaled $4.1 million, virtually unchanged from $4.2 million in the previous quarter, and up 11% from $3.8 million the same period in 2005. G&A expense in 2006 includes higher legal fees than in 2005 which are associated with intellectual property related activity.

Non-cash operating expenses (Depreciation, amortization, and non-cash stock compensation expenses)

Depreciation and amortization of property, equipment, and acquired intangible assets totaled $1.9 million, versus $2.5 million in the previous quarter, and $2.0 million in the year ago quarter. Non-cash stock compensation expense in the second quarter of 2006 increased to $0.9 million from $0.2 million last year, due mainly to the application of SFAS 123®.

Liquidity, capital resources, and assets held for sale

At June 30, 2006 the company had $10.3 million of cash and cash equivalents, about the same as at the previous quarter end. Revolving credit debt was zero, versus $3 million at March 31, 2006. The company's continuing operations EBITDA was $4.7 million, and $4.3 million of cash was generated from reducing working capital investment, mainly by lowering days' revenue in receivables. Funds were used for capital investments (including software development) of $1.0 million, cash interest of $0.5 million, net spending associated with discontinued operations of $2.6 million, leaving approximately $5 million for net debt reduction.

Backlog

As of June 30, 2006, the company's continuing operations backlog was approximately $104 million, as compared to $115 million at the end of the previous quarter, and down from $122 million at year end 2005. Backlog expected to be realized in the next twelve months is $57 million, as compared to $61 million at the end of the previous quarter and $59 million at the previous year end.

About the Presentation of EBITDA

EBITDA is not a financial measure calculated and presented in accordance with U.S. generally accepted accounting principles (GAAP) and should not be considered as an alternative to net income, operating income or any other financial measures so calculated and presented, nor as an alternative to cash flow from operating activities as a measure of our liquidity. We define EBITDA as net income/(loss) before non-cash stock compensation expense; amortization of software development costs, property and equipment and other intangibles; depreciation; and interest expense and other non-cash financing costs. Other companies (including our competitors) may define EBITDA differently. We present EBITDA because we believe it to be an important supplemental measure of our performance that is commonly used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Management also uses this information internally for forecasting and budgeting. It may not be indicative of the historical operating results of TCS nor is it intended to be predictive of potential future results. You should not consider EBITDA in isolation, or as a substitute for analysis of our results as reported under GAAP. See "GAAP to non-GAAP Reconciliation" below for further information on our non-GAAP measure.

GAAP to non-GAAP Reconciliation 3 months ended June,

(amounts in thousands) 2006 2005

Consolidated Statement of Operations

Reconciliation (unaudited)

Net loss on a GAAP basis $(1,555) $(4,038)

Depreciation and amortization of

property and equipment 1,857 2,019

Interest, financing, and other costs 821 418

Amortization of software development costs 281 157

Non-cash stock compensation expense 917 207

Amortization of acquired intangible assets 37 37

Loss from Enterprise operations held for

sale 2,314 1,722

EBITDA from continuing operations $4,672 $522

Consolidated Statement of Operations

Reconciliation per Share

Net loss per share on a GAAP basis $(0.04) $(0.10)

Depreciation and amortization of

property and equipment 0.05 0.05

Interest, financing, and other costs 0.02 0.01

Amortization of software development costs 0.01 0.00

Non-cash stock compensation expense 0.02 0.01

Amortization of acquired intangible assets 0.00 0.00

Loss from Enterprise operations held for

sale 0.06 0.04

EBITDA from continuing operations per share $0.12 $0.01

Shares used in calculation 39,313 38,725

Conference Call

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment