GPS Leader Navigates Through Tight Market

location based services

AP) -- After starting out by helping pilots get around, navigational device maker Garmin Ltd. is now more likely to aid a motorist in finding the quickest interstate or the nearest pizza parlor. But as drivers have snapped up millions of the satellite-reading devices for their cars, the surge in interest has attracted new and bigger players into what had been a rather isolated market. Now Garmin could need one of its GPS units just to keep from getting lost.

The Global Positioning System relies on 24 orbiting satellites maintained by the Defense Department for public use that allow users to triangulate their precise position.

At one time limited to pilots, boaters and the military, GPS units have become more commonplace as prices have come down and user-friendliness has gone up.

Research firm Strategy Analytics estimates that the number of GPS devices sold worldwide - including personal navigation units and applications built into cell phones and handheld computers - will grow from 18 million last year to 88 million in 2010. Garmin owns the U.S. title for personal navigation devices not built into dashboards, with more than 50 percent of the market.

Sony Corp. introduced its first GPS device this spring and Royal Philips Electronics NV, the biggest consumer electronics firm in Europe, has said it plans to get into the navigational game later this year. After-market auto parts manufacturers like Pioneer Electronics Inc., Kenwood Corp. and JVC Americas Corp. have followed suit.

Executives at Garmin, which is based in the Cayman Islands but headquartered in suburban Kansas City, say that while they respect the financial and brand-name power these companies have, they aren't too worried of being swept aside.

"Are they really focused on the markets we're focused on, or are they just trying to get in on the game because it's a growth business?" said Kevin Rauckman, the company's chief financial officer. He added: "Actually what they do is they do bring credibility."

Garmin plans to defend its position by continuing to roll out scores of new products - an expected 66 standalone models this year, compared to 55 last year, expanding the number and types of features.

"What we've done over time is try to make user interface and application and software as easy to use as possible," Rauckman said. "When the consumer sees what's available, they go, `Oh, this is easy to use and something I can take advantage of in my daily life.'"

When it started selling GPS units in 1991, Garmin was known mostly in the aviation and marine industries. It later made inroads to the outdoor and fitness crowd, selling handheld units that could keep mountain bikers from getting lost and help marathoners track their heart rate and calories burned.

That's what attracted Sean Staggs when he bought a Garmin Forerunner in February, figuring it would act as a training buddy as he jogged and biked around Kansas City.

Later, a friend pointed out that the device, which can track where a user has gone on a map and send the information to a computer, could help Staggs with the charity runs and bike rides he organizes for the National Multiple Sclerosis Society.

"That's been amazingly helpful," Staggs said, planning for an upcoming 150-mile ride between Kansas City and Sedalia, Mo. "I'm going to ride the route and when I'm done, the Garmin will have plotted the course and we can send that out to the participants."

But it's the driving segment that has really taken off for Garmin, pushing sales past $1 billion last year for the first time. While Rauckman said all of the company's market segments will see double-digit revenue increases this year, driving-related units now make up half of sales.

Garmin Car Navigation

CHOICE test & compare Garmin car navigation sytems. See the results.

U.S. drivers have embraced the technology as devices have become more sophisticated with color screens, audio turn-by-turn directions and better user interfaces. Newer units now include weather and traffic information and future models could provide ratings of nearby restaurants and hotels or offer satellite radio and MP3 players.

"There's increased room for innovation in the years ahead," said Ross Rubin, director of industry analysis at the NPD Group. As an example, he expects systems to direct drivers by landmarks, not just street names.

It also helps that prices are falling. Rubin noted that the average GPS unit sold for more than $800 last year but is now down to $664. Amazon.com Inc. and Wal-Mart Stores Inc. are selling a stripped-down Garmin for $200. Sony entered the market with a more bare-bones unit that sells for about $440.

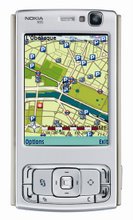

Garmin also teamed up last year with Sprint Nextel Corp. to provide subscribers turn-by-turn directions over their cell phones.

Strategy Analytics researchers suggest those kinds of applications could lead to a drop-off in demand for standalone navigation units like Garmin's.

Rubin disagreed, saying there's still plenty of room in the industry. In either case, he said, Garmin appears well-equipped to deal with changes in customer demand.

He noted that when European GPS leader TomTom International BV launched a smaller and easier-to-use product last year, Garmin came out with the StreetPilot c300 series, selling for between $600 and $400, which "has become the most popular GPS unit in the marketplace."

Wall Street has noticed, almost doubling Garmin's stock price in the past year to around $100 a share. Shareholders have approved an August stock split.

"Garmin continues to grow faster than the market and has accelerated for the last two months," analyst Jeff Evanson of Dougherty & Co. wrote in a recent research note.

Looking ahead, Garmin officials see the next big challenge isn't new competitors but breaking more into the European market, where it has a little more than 10 percent share. Rauckman said the market is different from the U.S. because Europeans have had more experience with GPS technology and need it more because of the sometimes chaotic road systems there. In addition, Europe lacks ubiquitous retailers like Best Buy or Wal-Mart, forcing the company to focus on individual outlets in each country.

"We have sold 15 million units over the life of the company," Rauckman said. "We haven't arrived. Garmin still has a lot more market growth opportunities in the future."

By DAVID TWIDDY, AP Business Writer

© 2006 The Associated Press. All rights reserved. This material may not be

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment