GIS/Geospatial Market Grew 17% in 2005

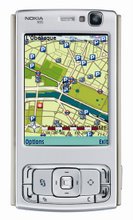

location based services

According to DaraTech (USA) worldwide GIS/geospatial revenue is forecast to reach US$3.6 billion in 2006, up from US$2.82 billion in 2004. This growth is driven by sales of commercial data products and the emergence of desktop and Internet-based systems.

Core-business revenue includes software, hardware, services and data products. The breakdown for these areas for 2004 is as follows:

Software comprised over one-half of total revenue, with revenues from GIS software vendors reaching $1.5 billion. Leading the market in software revenues were Environmental Systems Research Institute, Inc. (ESRI), Bentley Systems, Incorporated and Intergraph Corporation. Together, the three companies accounted for about half of the industry’s total software revenues. Other software leaders included Autodesk, Inc., Leica Geosystems, GE Energy, MapInfo, MacDonald Dettwiler, SICAD Geomatics, and LogicaCMG.

Data was the second largest component of core-business revenues, accounting for a quarter of total revenue, or $677 million. Sales of commercial data sets are skyrocketing and are projected to continue to grow strongly as consumers and businesses become more aware of and purchase geo-enabled devices. Services came in third, with core-business vendors accounting for one fifth of total core-business revenues, or $536 million.

Hardware, a declining component of core-business revenues for many years, dropped again, and accounted for just 4% of total core-business revenues, or $113 million.

Revenues from the public sector—the two major segments being state and local governments, and federal governments—led market growth and now account for over one-third of total revenue. While federal governments were among the early adopters of GIS technology, recent trends toward devolving more responsibilities to states and localities have spurred those entities to become important consumers of GIS.

Industries in the regulated sector—utilities, telecommunications, transportation and education—once again are the largest consumers of GIS/Geospatial solutions. Utilities contributed almost half of total regulated-sector GIS revenues, while telecommunications companies accounted for a third.

Private sector growth continues to lag, as companies explore the business benefits of these technologies. Of the major industry segments within the private sector, earth resources represent the largest opportunity, accounting for over one-quarter of total private-sector revenue. Also notable is the AEC segment, driven by growing acceptance of geo-capable engineering applications.

In-depth analysis of the structure and composition of the GIS/Geospatial market, a detailed description of Daratech’s GIS/Geospatial market model, profiles of major core-business participants and their product lines, and other background information is available online in the just-released publication " GIS/Geospatial Markets and Opportunities ."

Source: DaraTech, Inc

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment