Value-Added Offerings to Spur Growth of Location-Based Services

location based services

SINGAPORE, July 3 /PRNewswire/ -- Location-based services (LBS) which

have largely remained untapped in Asia-Pacific expects to show promising

growth in tandem with the introduction of mash-up services and increase in

mobile advertising.

New analysis from global growth consulting company, Frost & Sullivan

(http://www.mobileandwireless.frost.com), Asia Pacific Location-based

Services Market, reveals that the market -- covering 13 major Asia-Pacific

economies -- had a previous worth of US$291.7 million in 2006, and expects

this to grow at a CAGR (compound annual growth rate) of 15.3 percent

(2006-2009) to reach an estimated US$447 million by the end of 2009.

If you are interested in a virtual brochure, which provides service

providers, vendors/manufacturers, end users, and other industry

participants with an overview of the Asia Pacific Location-based Services

Market, then send an e-mail to Sarah Lourdes, Corporate Communications, at

sarah.lourdes@frost.com with your full name, company name, title, telephone

number, fax number and e-mail address. Upon receipt of the above

information, an overview will be sent to you by e-mail.

"LBS will emerge as the benchmark for service differentiation among

mobile operators. Despite remaining a fairly small segment, this niche

market gradually shifts from a mere complementary service into a

significant source of revenues," says Frost & Sullivan industry manager

Janice Chong.

LBS, which encompass a complex eco-system of application developers,

content providers, merchants and advertisers, demonstrate the progressive

demand of mobile users for more control over content and services that

operators provide.

"The implementation of a full-spectrum LBS which includes mash-up

services can significantly expedite the creation of a robust mobile content

eco-system in the various Asia-Pacific countries," Chong adds.

Japan and South Korea became by far the most developed LBS markets

accounting for nearly 92 percent of the total revenues in Asia-Pacific.

Much of this became attributed to the advanced data market in both these

countries, the existence of a complete mobile eco-system which proves

conducive for both application developers and content providers, and the

availability of reasonable LBS plans with flat rates.

"These markets also exhibit a much higher consumer-to-enterprise LBS

ratio. The consumer segment provides a more durable payoff since a tight

nexus to mobile advertising exists, allowing more potential for growth,"

notes Chong.

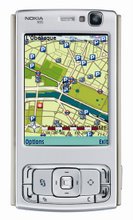

The demand for LBS in the rest of Asia-Pacific however has become

primarily inhibited by various issues including privacy infringement

concerns, inter-operability issues, lack of advanced GPS (global

positioning system)-enabled handsets, and to a large extent, a general lack

of a conducive eco-system and user interest.

In most of these markets, mobile operators' foremost priority has

become limited to expanding subscriber base and driving greater data

traffic amongst mobile users -- offering basic mobile data services which

provide simplicity, quicker return-on-investment (ROI), and appeal to a

larger target audience.

"However, with wider availability of GPS-enabled handsets, value-added

mash-up services and intense advertising, the adoption of LBS throughout

the rest of Asia-Pacific expects to increase," says Chong.

The Asia Pacific Location-based Services Market study is part of the

Mobile and Wireless subscription, which includes research services in the

following markets: mobile communications, mobile enterprise, premium

content and applications, and mobile video services. All research services

included in subscriptions provide detailed market opportunities and

industry trends evaluated following extensive interviews with market

participants. Analyst interviews are available to the press.

Frost & Sullivan, a global growth consulting company, has been

partnering with clients to support the development of innovative strategies

for more than 40 years. The company's industry expertise integrates growth

consulting, growth partnership services, and corporate management training

to identify and develop opportunities. Frost & Sullivan serves an extensive

clientele that includes Global 1000 companies, emerging companies, and the

investment community by providing comprehensive industry coverage that

reflects a unique global perspective, and combines ongoing analysis of

markets, technologies, econometrics, and demographics. For more

information, visit http://www.frost.com

Contact:

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment