Forget media downloads. Cell customers really want GPS and navigation features

First, cell phones made the streetcorner pay phone obsolete. Now they're doing away with the need to ask for directions. A surge in phones with built-in satellite navigation capability has sparked a wave of creative mapping and locating services. And it has set off a multibillion-dollar scramble by companies to buy up digital navigation technologies.

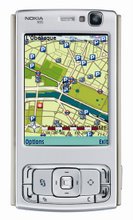

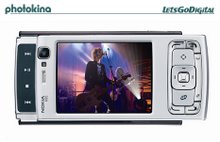

The number of navigation-ready cell phones will hit 162 million this year, or more than seven times the number of such devices sold for use in cars or other nonphone gadgets, says researcher iSuppli. You only have to scan phone company ads to see how they are touting navigational features: The new N95 smartphone from Nokia (NOK ) plays music and videos, but it also has a chip that receives signals from the government's Global Positioning System satellites, enabling the phone to display maps. Research In Motion (RIMM ) is already putting navigation features into its BlackBerry smartphones. Other big phonemakers including Motorola (MOT ) and Samsung are doing the same. Apple (AAPL ), having put a version of Google (GOOG ) Maps on its iPhone, is widely expected to add GPS chips and live mapping in 2008.

Phone carriers and software developers alike have been quick to offer location-based services that go way beyond simple street directions. Verizon's (VZ ) Chaperone service allows parents to track the location of kids from their phones or on the Web and sends a message when they reach their destination. Loopt lets Sprint (S ) and Boost Mobile customers track friends--imagine a buddy list overlaid on a map--and sends alerts when they're nearby. Services like those rang up $92 million in sales in the third quarter, or 58% of what consumers spent to download software to phones, Nielsen Mobile found. This spring, wireless users spent on average nearly twice as much on navigation as they did to download music to their phones, says David Gill, a Nielsen Mobile analyst.

To understand why phone-based navigation is suddenly so hot, talk with Debby Ramundo. The senior project manager at Seattle's Swedish Medical Center, Ramundo oversees 200 doctors and nurses who visit patients who can't travel to a doctor's office. Like millions of other people, clinicians are hard-pressed to get to the right place on time. That can be especially tricky in fast-growing Seattle, where new residential streets pop up out of nowhere. So last year the medical center handed out GPS-equipped Nextel cell phones. The phones offer such features as spoken turn-by-turn directions.

Such options until recently could be found only in $300-plus dashboard devices. The software, from TeleNav, a Sunnyvale (Calif.) company, costs each user $10 a month. But Ramundo says efficiency gains for medical workers more than offset the added costs: "Every hour they're not here in the office getting directions or getting lost is a billable hour they're out seeing patients."

THE GPS BANDWAGON

For years, satellite-based navigation technology was restricted to the military, which used it to position troops or guide missiles. The government purposely made GPS signals too fuzzy for civilians other than hikers or boaters to find useful. That changed in 2000, though, when civilians were given access to more accurate signals. An industry quickly sprang up for car-based navigation, which is a $6.8 billion business today, says iSuppli.

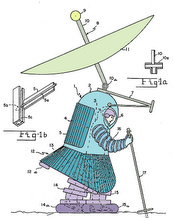

Now GPS phones are embedded with tiny chips that receive signals from the collection of 31 GPS satellites that blanket every inch of the Earth with a faint radio signal. A receiver needs to be within range of at least four satellites at once to determine its location accurately. That is drawn on-screen, matching latitude and longitude with maps sent via wireless Net connections.

As more players jump into navigation, it has triggered a wave of deal-making that reflects the nervousness of established players. Makers of car-based or other dedicated (nonphone) devices worry that competitors will gain control of essential mapping data, which show names and locations of streets, homes, restaurants, and hotels and must be regularly updated.

The two companies supplying that data, Chicago-based Navteq (NVT ) and Netherlands-based Tele Atlas, are now being rolled up. In July, one of the largest car-navigation outfits, Dutch concern TomTom, moved to acquire Tele Atlas for $2.3 billion. Stock in rival Navteq soared on the expectation it would be acquired by Garmin (GRMN ), TomTom's Olathe (Kan.)-based competitor, or perhaps Google or Microsoft (MSFT ), which operate mapping sites. But on Oct. 1 phone giant Nokia jumped in with an $8.1 billion deal to buy Navteq--a price nearly 14 times its $582 million in 2006 sales.

Faced with having to buy mapping data from a competitor, Garmin announced on Oct. 31 a hostile $3.3 billion bid for Tele Atlas. TomTom responded with a $4.3 billion offer. Garmin has until Dec. 4 to counter. The buyout binge isn't likely to end there. Analysts say possible targets include TeleNav, which supplies navigation software to carriers, and its rival Networks In Motion of Aliso Viejo, Calif. Also in the spotlight is Kirkland (Wash.)-based Inrix, spun off from Microsoft in 2004. It supplies live traffic data on 55,000 miles of U.S. roads. Its sole competitor, Traffic.com, was bought earlier this year by Navteq, and is becoming part of Nokia.

For navigation outfits that see Nokia as a competitor, that raised the possibility of losing access to traffic data as well as mapping data. So they're furiously signing agreements with Inrix, says President and CEO Bryan Mistele: "The last 120 days have been the best days in our company's history."

No comments:

Post a Comment