For handset makers, it's all about location

news analysis Nokia announces plans to spend $8.1 billion on Navteq. Why would it shell out so much for an outfit that's not well known?

By Erica Ogg Staff Writer, CNET News.com -->

Published: October 2, 2007, 4:00 AM PDT

Last modified: October 2, 2007, 10:22 AM PDT

TalkBackE-mailPrint del.icio.us Digg this

A correction was made to this story. Read below for details.

news analysis The young market for so-called location-based services may have just found a shortcut to mainstream adoption.

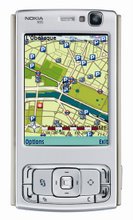

Nokia's announcement Monday that it will purchase digital-map provider Navteq for $8.1 billion illustrates the premium that both mobile handset and services providers are placing on location-based services. It could also mean that budding market will briskly move from niche service to standard feature.

"Everyone's going to have to move in that direction. You'll be missing something if you don't have (location-based services)," said analyst Jack Gold of J. Gold Associates.

Location-based services (LBS) is a phrase used to describe the combination of the mobile Web and GPS data. It's a feature that will become even more in demand as portable gadgets become ubiquitous and staying connected assumes first priority. Add-on services are also one of the most surefire ways for manufacturers to make a few extra dollars in profit margin on consumer hardware. A side effect of the appeal of LBS on omnipresent devices like cell phones is that standalone GPS devices could go the way of the PDA.

Up to now, location-based services for most people meant getting directions from one place to another. But the vast database of location data that companies like Navteq can provide to mobile service providers, ad and marketing companies, and hardware makers opens some intriguing possibilities.

Giving directions is one thing, but when your device knows where you are, a slew of services can be tailored to your specific geographic needs. You could, for example, find the closest Starbucks, the locals' favorite Thai restaurant, or the gas station with the lowest prices. You could plan for inclement weather, reroute your commute around road closures or accidents, compare prices while shopping for gadgets or appliances, or keep tabs on friends or family members.

That Nokia would be the one to scoop up Navteq wasn't necessarily expected, but the Chicago-based map provider has been an acquisition target since navigation device maker TomTom offered to purchase Navteq rival Tele Atlas this summer for just over $2 billion. Navteq is one of the largest providers of digital mapping services, and Google was seen as a likely suitor. The world's No. 1 handset maker stepped in instead, leaving Google and any others fairly slim pickings in terms of acquisition targets now that the two biggest LBS companies have been snatched up.

LBS will be in higher demand by a whole host of industries beyond mobile phones, namely business that sell, well, anything, Gold said. Auction sites, like eBay for example, could find location services helpful in authenticating mobile purchases from its site. And companies such as Google, Yahoo and Microsoft that are targeting advertisements will always want more specific information about consumer characteristics, preferences and locations to tailor their messages.

The technology to do this is already available, but for the most part, it is not yet linked to an individual's specific location. The availability of GPS chips in devices is the main barrier in mainstream adoption. "We're very GPS-poor from a device standpoint," especially here in the U.S., said Gold.

CONTINUED: GPS chips getting cheape...

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment